Global Markets Reel Under Trump’s Tariff Storm

May 7, 2025

A wave of Asian stock indexes tumbled while the U.S. dollar surged following the latest tariff decision from President Trump.

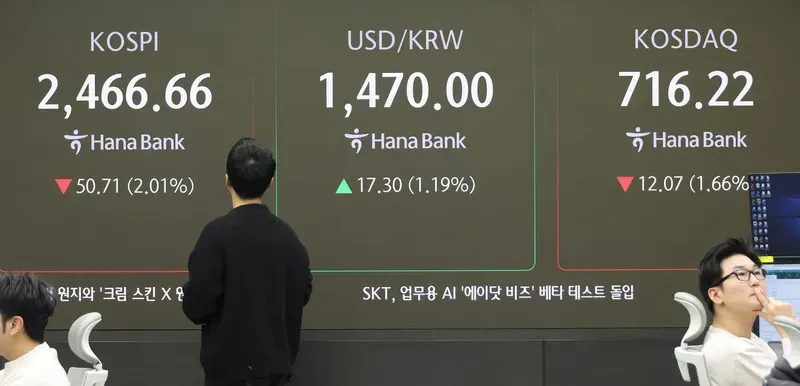

South Korea's KOSPI index dropped sharply in the morning session of February 3, while the exchange rate between the USD and the Korean won also rose (Photo: YONHAP).

According to the Financial Times, President Donald Trump's decision to impose tariffs on imported goods from Canada, Mexico, and China sent global markets reeling on February 3.

Stock markets plunge

On February 1, Trump signed an executive order imposing tariffs of up to 25% on all imports from Mexico and most goods from Canada, along with a 10% tariff on Chinese imports to the U.S.

The first trading session after the announcement - and also after the Lunar New Year holiday—saw Asian stock indexes nosedive.

As of 11:30 AM (Vietnam time), Hong Kong's Hang Seng Index had dropped 0.74%. South Korea’s KOSPI plunged over 3%.

Japan followed suit, with the Nikkei 225 falling 2.83% and the Topix Index down 2.44%. Australia's S&P/ASX 200 dropped 1.92%.

China’s market - the only Asian country directly targeted by the tariffs - remained closed and was not scheduled to reopen until February 5.

The market plunge extended beyond Asia. In the U.S., S&P 500 futures dropped 1.7%, and Nasdaq 100 futures fell by 2.3%.

In Europe, Euro Stoxx 50 futures also dropped at one point by 2.6%.

U.S. dollar strengthens sharply

U.S. President Donald Trump signs an executive order in the Oval Office at the White House, Washington D.C., on January 31 (Photo: REUTERS)

While equities dropped, the U.S. dollar surged against multiple currencies following Trump's aggressive trade policy.

On the morning of February 3, the Chinese yuan fell 0.7% against the dollar, trading at 7.37 CNY per USD. The Mexican peso declined by over 2%, reaching 21.15 pesos per USD. Even the euro, despite Europe not being directly affected yet, lost 1% against the dollar.

The Canadian dollar also weakened to 1.473 CAD per USD - the lowest level since 2003.

Meanwhile, oil prices rose slightly. In early Asian trading, Brent crude increased 0.6% to $76.13 per barrel.

Jason Lui, head of equity and derivatives strategy for Asia-Pacific at BNP Paribas, commented:

“Markets were once optimistic that the tariff threats were just a negotiation tactic, but they’ve underestimated the Trump administration’s resolve.”

Gabriela Siller, chief economist at Banco Base in Mexico, warned:

“If these tariffs are maintained for several months, exchange rates could reach new highs. If left in place, the tariffs could cause structural changes in Mexico’s economy. The country may fall into recession and take years to recover.”

Source: Translated from Tuổi Trẻ Newspaper, by Ngọc Đức.

(Original article available here)

Business

May 7, 2025

May 7, 2025